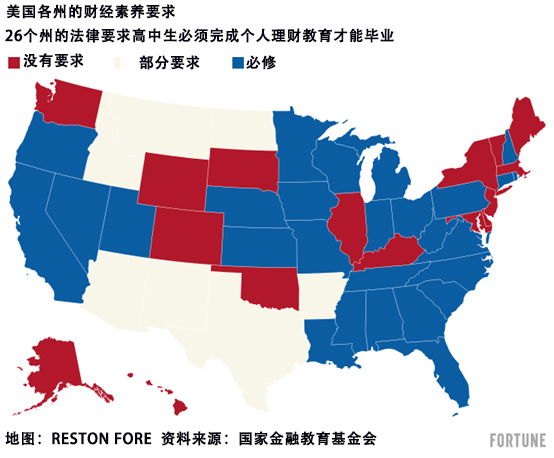

金融专家戴夫·拉姆齐在26岁时申请过破产,如今他是全美超过700万高中生的个人理财代言人。这要部分归功于现在美国有26个州要求高中生必须完成财经素养课程才能毕业。

由于学校已经面临教师人手不足的问题,因此教授个人理财课程的责任往往落在了那些本身就财经素养不高的历史老师或体育老师身上,结果他们只能播放一学期的专家视频,例如拉姆齐的视频。

虽然教师相关专业知识的匮乏是导致教学效果参差不齐的部分原因,但金融专家表示,根本原因是全国范围内的财经素养缺失。

宾夕法尼亚大学(University of Pennsylvania)沃顿商学院(Wharton School)的金融学教授迈克尔·罗伯茨表示,在美国,允许18岁的年轻人申请10万美元的大学贷款,而他们自己或他们的父母却没有足够的理财知识来了解这笔贷款对其人生造成的长期影响,这对他们来说是一种“伤害”。

罗伯茨对《财富》杂志表示:“人们早就已经认识到,一个人要想成为一位积极、成功和幸福的公民,理财教育至关重要。想想理财对你我生活的重要性,这真的不可或缺。”

根据美国财经素养卓越中心(Global Financial Literacy Excellence Center)与美国教师保险和年金协会(TIAA)的数据,大多数成年人在做出财务决策时财经素养水平较低,其中Z世代的财经素养最差。在1990年代末和2000年代初出生的这一代人只能回答37%的借贷、投资和储蓄相关问题。考虑到七分之一的Z世代信用卡用户已经透支了额度,而且仅在美国,学生贷款债务就超过2万亿美元,这一数据令人震惊。

总体而言,根据WalletHub的数据,四分之一的Z世代对自己的理财知识和技能没有信心,超过三分之一的人表示他们的父母在理财方面并没有为他们树立良好的榜样。

然而,并非所有人都认为专门的个人理财课程是在有效利用学生的时间。

有一项广为流传的研究表明:“几乎没有证据证明旨在改善财务决策的教育是成功的。”相反,这项研究建议加强数学教育,可以在以后改善学生的市场参与、投资收入和信用管理。另一项研究指出,“旨在提高财经素养的干预措施只能解释0.1%的金融行为差异,在低收入样本中效果更弱”,而且由于学生可能很快忘记所学内容,必修课程的效果微不足道。

然而,这两项都是十多年前的研究,当时只有大约五个州要求提供财经素养教育。现在,又有21个州通过了要求提供财经素养教育的法律。

美国国家财务教育基金会(National Endowment for Financial Education)总裁兼首席执行官比利·亨斯利解释称,造成分歧的部分原因是历史上缺乏数据和少数研究的主导地位。他补充说,现在有压倒性的证据证明财经素养教育是有效的——前提是方法得当。

他指出,国家财务教育基金会的研究部分显示,参加本州规定的理财教育课程的学生有信用卡欠款的概率降低了21%,私人贷款平均减少了1,300美元,获得经济援助的可能性提高了3.5%。

如何教授个人理财课程

随着越来越多的州要求开设个人理财课程,美国各地的学区不得不争相寻找合格的教师。然而,在许多州,教育工作者在教授个人理财课程之前,并不需要证明自己在该领域的专业水平。

今年夏天,加利福尼亚州成为最近一个将财经素养要求纳入学校课程的州。社会科学、商业、数学和家政学的教师被特别授权教授这门课程,但新出台的法律也授权其他学科的教育工作者提供个人理财课程。

罗伯茨表示,他对正在教授个人理财课程的老师感到“非常担心”。虽然教授某些知识或许并不难,比如什么是支票账户等,但学生需要精通金融知识才能真正提高财经素养。例如,年轻人应该能够辨别买房和租房哪个选择更好,或者选择固定利率还是浮动利率的抵押贷款。

罗伯茨表示:“你必须教会老师。一切都必须从那里开始,最好的方法是让他们自己参加课程。有多少教师实际上接受过个人理财方面的正式培训?我想不会有太多。”

拥有超过240万TikTok粉丝的拉姆齐认同学校开展财经素养教育“至关重要”,但他表示个人理财有20%依靠学到的知识,有80%取决于行为。他的个人理财课程已被推广至美国45%以上的高中。

拉姆齐对《财富》杂志表示:“太多的学生在成年后背负债务,导致压力和焦虑,这不值得。你越早学习如何理财,就能越快开始积累财富,并影响你的家族的命运。”

亨斯利表示,由于缺乏国家战略,个人往往会向社交媒体和网红寻求理财建议。

然而,一项调查发现,27%的社交媒体用户曾被虚假或误导性的理财信息所欺骗,年轻人更容易上当。TikTok上只有十分之一的理财网红会如实公布他们的背景信息。

亨斯利表示:“理财教育不是一刀切的,你不能盲目相信你在网上或其他媒体上看到或听到的一切,而且世界上根本没有快速积累财富或获得财务安全的万无一失的方法。此外,一些网红的知名度越高,就越有可能会收到某些品牌的付款,这可能会影响他们所讲述的内容。”

从辩论中找到折中立场

虽然亨斯利不认为教育提供者应该受到指责,但他表示,美国的经济体系崩溃,导致某些低收入群体遭到系统性的虐待。

同样,金融普及研究所(Financial Access Institute)常务董事蒂莫西·奥格登在一篇专栏文章中写道,美国人陷入了财务困境,因为“高等教育、健康保险、儿童保育和租金等成本的上涨速度,都远远超过了工资的增长速度”。

然而,在关于财经素养教育要求的辩论中,奥格登和亨斯利却站在了对立面。奥格登认为,增加预算制定或利率等方面的知识不一定会改变行为;而亨斯利则认为,财经素养可以真正产生积极的影响。

亨斯利表示,与其花时间选择立场,不如将精力用于改善金融体系,造福所有人。

亨斯利表示:“每个人至少在生活中的某个时刻会希望自己掌握了更多理财知识。”(财富中文网)

译者:刘进龙

审校:汪皓

金融专家戴夫·拉姆齐在26岁时申请过破产,如今他是全美超过700万高中生的个人理财代言人。这要部分归功于现在美国有26个州要求高中生必须完成财经素养课程才能毕业。

由于学校已经面临教师人手不足的问题,因此教授个人理财课程的责任往往落在了那些本身就财经素养不高的历史老师或体育老师身上,结果他们只能播放一学期的专家视频,例如拉姆齐的视频。

虽然教师相关专业知识的匮乏是导致教学效果参差不齐的部分原因,但金融专家表示,根本原因是全国范围内的财经素养缺失。

宾夕法尼亚大学(University of Pennsylvania)沃顿商学院(Wharton School)的金融学教授迈克尔·罗伯茨表示,在美国,允许18岁的年轻人申请10万美元的大学贷款,而他们自己或他们的父母却没有足够的理财知识来了解这笔贷款对其人生造成的长期影响,这对他们来说是一种“伤害”。

罗伯茨对《财富》杂志表示:“人们早就已经认识到,一个人要想成为一位积极、成功和幸福的公民,理财教育至关重要。想想理财对你我生活的重要性,这真的不可或缺。”

根据美国财经素养卓越中心(Global Financial Literacy Excellence Center)与美国教师保险和年金协会(TIAA)的数据,大多数成年人在做出财务决策时财经素养水平较低,其中Z世代的财经素养最差。在1990年代末和2000年代初出生的这一代人只能回答37%的借贷、投资和储蓄相关问题。考虑到七分之一的Z世代信用卡用户已经透支了额度,而且仅在美国,学生贷款债务就超过2万亿美元,这一数据令人震惊。

总体而言,根据WalletHub的数据,四分之一的Z世代对自己的理财知识和技能没有信心,超过三分之一的人表示他们的父母在理财方面并没有为他们树立良好的榜样。

然而,并非所有人都认为专门的个人理财课程是在有效利用学生的时间。

有一项广为流传的研究表明:“几乎没有证据证明旨在改善财务决策的教育是成功的。”相反,这项研究建议加强数学教育,可以在以后改善学生的市场参与、投资收入和信用管理。另一项研究指出,“旨在提高财经素养的干预措施只能解释0.1%的金融行为差异,在低收入样本中效果更弱”,而且由于学生可能很快忘记所学内容,必修课程的效果微不足道。

然而,这两项都是十多年前的研究,当时只有大约五个州要求提供财经素养教育。现在,又有21个州通过了要求提供财经素养教育的法律。

美国国家财务教育基金会(National Endowment for Financial Education)总裁兼首席执行官比利·亨斯利解释称,造成分歧的部分原因是历史上缺乏数据和少数研究的主导地位。他补充说,现在有压倒性的证据证明财经素养教育是有效的——前提是方法得当。

他指出,国家财务教育基金会的研究部分显示,参加本州规定的理财教育课程的学生有信用卡欠款的概率降低了21%,私人贷款平均减少了1,300美元,获得经济援助的可能性提高了3.5%。

如何教授个人理财课程

随着越来越多的州要求开设个人理财课程,美国各地的学区不得不争相寻找合格的教师。然而,在许多州,教育工作者在教授个人理财课程之前,并不需要证明自己在该领域的专业水平。

今年夏天,加利福尼亚州成为最近一个将财经素养要求纳入学校课程的州。社会科学、商业、数学和家政学的教师被特别授权教授这门课程,但新出台的法律也授权其他学科的教育工作者提供个人理财课程。

罗伯茨表示,他对正在教授个人理财课程的老师感到“非常担心”。虽然教授某些知识或许并不难,比如什么是支票账户等,但学生需要精通金融知识才能真正提高财经素养。例如,年轻人应该能够辨别买房和租房哪个选择更好,或者选择固定利率还是浮动利率的抵押贷款。

罗伯茨表示:“你必须教会老师。一切都必须从那里开始,最好的方法是让他们自己参加课程。有多少教师实际上接受过个人理财方面的正式培训?我想不会有太多。”

拥有超过240万TikTok粉丝的拉姆齐认同学校开展财经素养教育“至关重要”,但他表示个人理财有20%依靠学到的知识,有80%取决于行为。他的个人理财课程已被推广至美国45%以上的高中。

拉姆齐对《财富》杂志表示:“太多的学生在成年后背负债务,导致压力和焦虑,这不值得。你越早学习如何理财,就能越快开始积累财富,并影响你的家族的命运。”

亨斯利表示,由于缺乏国家战略,个人往往会向社交媒体和网红寻求理财建议。

然而,一项调查发现,27%的社交媒体用户曾被虚假或误导性的理财信息所欺骗,年轻人更容易上当。TikTok上只有十分之一的理财网红会如实公布他们的背景信息。

亨斯利表示:“理财教育不是一刀切的,你不能盲目相信你在网上或其他媒体上看到或听到的一切,而且世界上根本没有快速积累财富或获得财务安全的万无一失的方法。此外,一些网红的知名度越高,就越有可能会收到某些品牌的付款,这可能会影响他们所讲述的内容。”

从辩论中找到折中立场

虽然亨斯利不认为教育提供者应该受到指责,但他表示,美国的经济体系崩溃,导致某些低收入群体遭到系统性的虐待。

同样,金融普及研究所(Financial Access Institute)常务董事蒂莫西·奥格登在一篇专栏文章中写道,美国人陷入了财务困境,因为“高等教育、健康保险、儿童保育和租金等成本的上涨速度,都远远超过了工资的增长速度”。

然而,在关于财经素养教育要求的辩论中,奥格登和亨斯利却站在了对立面。奥格登认为,增加预算制定或利率等方面的知识不一定会改变行为;而亨斯利则认为,财经素养可以真正产生积极的影响。

亨斯利表示,与其花时间选择立场,不如将精力用于改善金融体系,造福所有人。

亨斯利表示:“每个人至少在生活中的某个时刻会希望自己掌握了更多理财知识。”(财富中文网)

译者:刘进龙

审校:汪皓

Finance guru Dave Ramsey—who filed for bankruptcy at age 26—is the face of personal finance to over seven million students in high schools across the country. That’s due, in part, to the 26 states that now require financial-literacy coursework to graduate high school.

With schools already struggling to fill teacher vacancies, the responsibility to teach personal finance often falls to not-so-financially literate history teachers, or P.E. instructors, who end up showing a semester’s worth of videos from experts like Ramsey.

While a lack of faculty expertise is part of the uneven process, financial experts say a lack of financial literacy countrywide is to blame.

The country is doing a “disservice” to 18-year-olds by allowing them to sign up for $100,000 in college loans—without them or their parents having the financial proficiency to know the life-long impact, said Michael Roberts, professor of finance at the University of Pennsylvania’s Wharton School.

“It’s long been recognized that financial education is paramount to being an engaged and hopefully prosperous and happy citizen,” Roberts told Fortune. “If you think about the importance of finance for your life, for my life, for our lives, it’s really unavoidable.”

Most adults are making financial decisions with a poor level of financial literacy, according to the Global Financial Literacy Excellence Center and TIAA, with Gen Z having the poorest literacy. Those born between the late 1990s and early 2000s were only able to answer 37% of questions about topics like borrowing, investing, and saving. This is staggering considering that one in seven Gen Z credit-card users have already maxed out their cards, and in the U.S. alone, students hold over $2 trillion in student loan debt.

Overall, one in four Gen Zers are not confident in their financial knowledge and skills—and more than one-third say their parents did not set a good example for them financially, according to WalletHub.

However, not everyone agrees that classes dedicated to personal finance are the best use of students’ time.

One widely-circulated study suggests “there is little evidence that education intended to improve financial decision-making is successful.” It instead suggests greater mathematics training can later lead to greater market participation, investment income, and credit management. Another study said “interventions to improve financial literacy explain only 0.1% of the variance in financial behaviors studied, with weaker effects in low-income samples,” and that required coursework is negligible due to how quickly students may forget what they learned.

Both these studies, however, were written over a decade ago—back when only about five states mandated financial literacy. Now, 21 additional states have passed financial-literacy requirements.

Billy Hensley, president and CEO of the National Endowment for Financial Education, explained that part of the division has been driven by a historic lack of data and the dominance of a small number of studies. Today, he added, the evidence is overwhelming: Financial literacy education works—when done right.

He points to NEFE research, which in part shows students taking state-mandated financial education courses have a 21% less likelihood of carrying a credit-card balance, have on average $1,300 less in private loans, and have a 3.5% increased likelihood of taking out financial aid.

Teaching how to teach personal finance

With a growing number of states requiring personal-finance courses, school districts across the country have had to scramble to find qualified teachers. Yet, in many states, educators do not need to prove expertise in the field before being placed into a personal-finance classroom.

This summer, California became the most recent state to add a financial-literacy requirement to its curriculum. Teachers in social science, business, mathematics, and home economics are specifically authorized to teach the course, but the new law also gives authority to educators in other subjects to oversee personal finance.

Roberts said he is “very concerned” about who is teaching personal finance across the country. While it may be easy to teach some things, like what a checking account is, students need to learn financial proficiency to truly be literate. For example, young adults should be able to discern whether it’s better to buy versus rent a house, or to sign up for a fixed- versus floating-rate mortgage.

“You have to teach the teachers,” Roberts said. “It all has to start there, and the best way to do that is to make them take the course themselves because how many teachers out there have actually been trained and had formal training in personal finance? I doubt very many.”

Ramsey, who has over 2.4 million TikTok followers, agrees that financial literacy in schools is “crucial,” but says personal finance is 20% head knowledge and 80% behavior. His personal-finance curriculum has been taught in over 45% of U.S. high schools.

“Too many students enter adulthood with debt, leading to stress and anxiety, and it’s just not worth it,” Ramsey tells Fortune. “The younger you can learn about handling money, the quicker you can start to build wealth and make a difference in your family tree.”

With the absence of a national strategy, individuals often turn to social media and influencers for financial advice, Hensley shared.

However, a survey found 27% of social-media users have fallen for false or misleading financial information, with younger adults more likely to do so. Only one in 10 financial influencers on TikTok are transparent about their background.

“FinEd is not one-size-fits-all and you cannot believe everything that you see/hear online or in other medium, and there are not any surefire ways to build wealth or financial security quickly. Also, the more popular a particular influencer becomes they are likely to be paid by certain brands, which could influence what they’re telling people,” Hensley said.

A debate with middle ground

While Hensley does not believe education providers are to blame, he said the economic system is broken and has led to the systemic abuse of certain low-income Americans.

In a similar vein, Timothy Ogden, the managing director of the Financial Access Institute, wrote in an op-ed that Americans’ finances are in distress due to “cost of higher education, health insurance, child care and rent have all increased far faster than paychecks.”

However, Ogden and Hensley are on opposite sides of the financial-literacy education requirement debate. Ogden argues an increased knowledge of budgeting or interest rates won’t necessarily change behavior; Hensley, on the other hand, believes financial literacy can truly make a positive impact.

Instead of spending time picking sides, Hensley says energy should be spent making the financial system better for all.

“Everyone (has) had at least one point in their life where they wish they had known much more about personal finance than they did,” Hensley said.